168极速赛车开奖结果查询,开奖结果历史查询|168极速赛车一分钟体彩,全国开奖记录结果查询 Discover the connectivity cloud

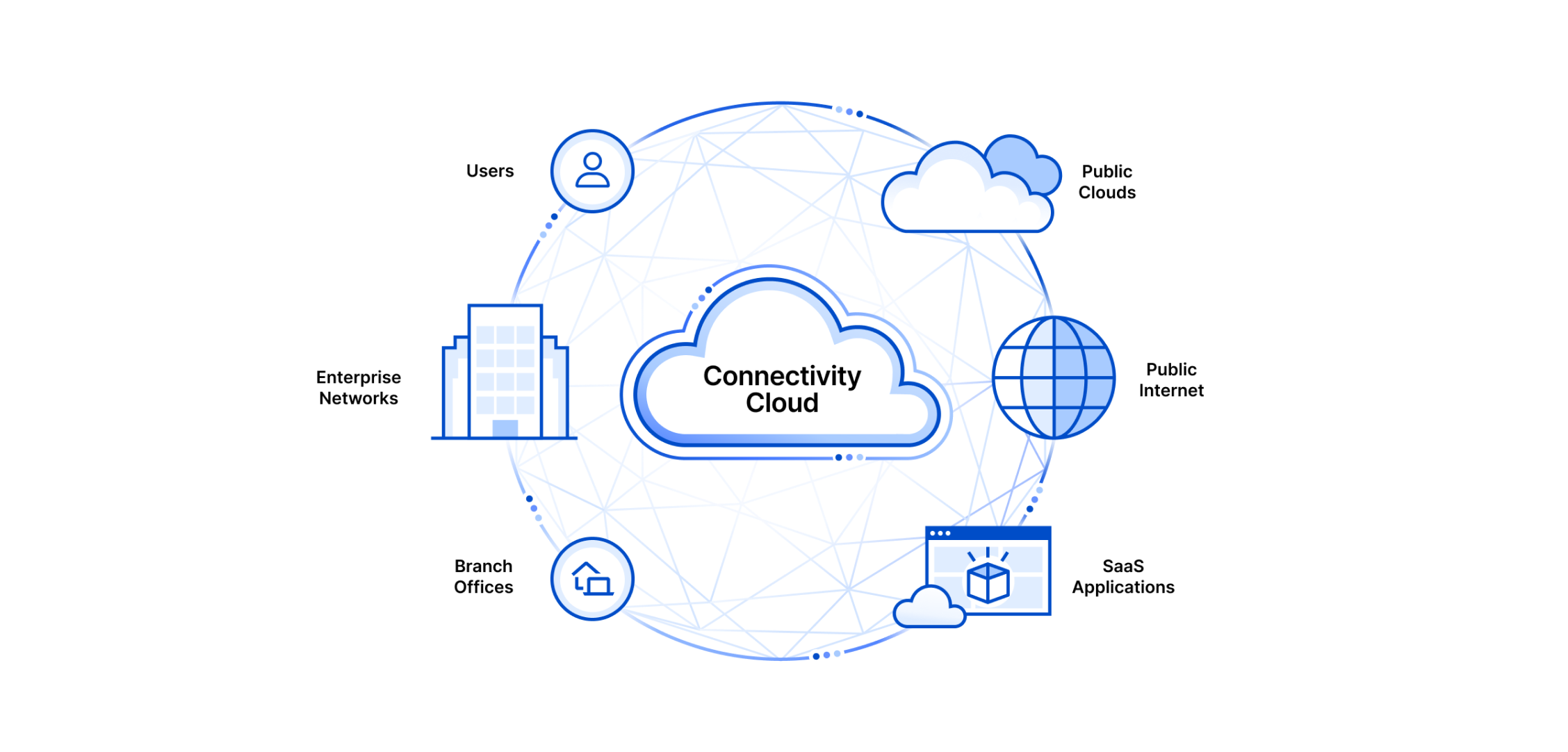

Regain control while connecting and protecting your people, apps and data everywhere.

Control

Control

Regain visibility and control of IT and security across on-prem, public cloud, SaaS, and the Internet

Security

Security

Improve security and resilience while reducing your attack surface, vendor count, and tool sprawl

Speed

Speed

Accelerate application and network performance while rapidly developing new applications

Cost

Cost

Reduce cost and complexity to reinvest resources in your highest priorities

168极速赛车开奖现场结果+开奖结果|手机app开奖查询软件|1分钟极速赛车开奖历史记录 Fulfilling the promise of single-vendor SASE through network modernization

A series of updates to our SASE platform, Cloudflare One, make SASE networking more flexible for security teams, more efficient for traditional networking teams, and uniquely extend its reach to DevOps teams — now with expanded site-to-site, WANaaS, mesh, and P2P networking capabilities.

Powered by an intelligent global network, our connectivity cloud is a unified platform that helps your business work, deliver, and innovate everywhere.

SASE and SSE services

Connect and secure your employees, contractors, devices, networks, apps, and data everywhere they live.

App and infrastructure services

Give your digital products and services top-notch security, reliability, and performance for customers everywhere.

Developer services

Easily build and deploy full-stack applications everywhere, thanks to integrated compute, storage, and networking.

What’s new 极速赛车一分钟-1分钟极速赛车168官网开奖结果查询-极速赛车记录开奖1分钟结果计划168网+在线历史记录官方

What analysts say

Cloudflare recognized as a Representative Vendor in Integrated Cloud Email Security (ICES) category

The 2023 Gartner® Market Guide for Email Security offers guidance for organizations to filter malicious content or suspicious interactions across multiple channels and prevent phishing attacks.

Cloudflare a Leader in 2023 Forrester Wave™: Enterprise Email Security

Cloudflare tied for the top score in the strategy category, and received the highest scores possible in the criteria of vision and innovation.

Cloudflare a Leader in 2023 IDC MarketScape: Zero Trust Network Access

IDC cites Cloudflare's "aggressive product strategy to support enterprise security needs."

30% of the Fortune 1000 rely on Cloudflare

Cloudflare’s connectivity cloud protects 900+ GPC websites, giving them complete visibility into threats across their entire digital footprint.

Cloudflare’s connectivity cloud powers Polestar’s global ecommerce and development operations, giving them resilience during launches and promotions.

Sage leverages Cloudflare to improve application performance and security, enhance product development, secure user data, and streamline their digital footprint.

Resources